CBN declares Access Bank the Most Sustainable Bank of the Year 2019

Summary

Access Bank has consistently won in several categories of the annual CBN Sustainability Awards.

The Nigerian financial services industry, this year, entered its 7th year of implementing the Nigerian Sustainable Banking Principles (NSBP). The Central Bank of Nigeria (CBN) had directed all commercial banks, discount houses and development finance institutions (DFIs) to implement the NSBP in 2012. As part of the adoption process, most banks developed products and initiatives specifically designed to deliver positive environmental and social impacts to society.

Following the introduction of the principles in the Nigerian banking industry, the apex bank also instituted the Central Bank of Nigeria's Sustainability Awards, which Access Bank Plc. has consistently won every year in several of the award categories. Last month, Access Bank was declared the Most Sustainable Bank of the Year for the third consecutive year at the 2019 edition of the CBN's Sustainability Awards.

The bank also emerged winner in four other categories of the annual awards. The four categories were: Most Sustainable Transaction of the Year (Agriculture); Most Sustainable Transaction of the Year (Oil and Gas Sector); Most Sustainable Transaction of the Year (Power Sector); and Bank of the Year for Women Economic Empowerment.

The CBN Sustainability Awards recognize and reward the sustainability performance of financial institutions with respect to their positive contributions to society and their commitment to implementing the Nigerian Sustainable Banking Principles. The principles provide the framework for a sustainable banking system in Nigeria. They provide guidelines for strong and effective governance of financial institutions and the development of products and services that create value for customers, clients, investors, as well as society.

To entrench sustainable banking in Nigeria, financial institutions are expected to align the Nigerian Sustainable Banking Principles with their business strategies to drive economic growth that is environmentally and socially responsible. Banks are expected to achieve these objectives by effectively managing the environmental and social (E&S) risks and opportunities, which are associated with their business operations.

According to the CBN, banks are also supposed to improve the lives of people through human rights protection, women empowerment and financial access. The principles also provide guidelines for collaborative partnerships and reporting progress. The NSBP recognise the banking sector’s role in delivering positive development impacts, which cannot be achieved without protecting the communities and environments in which banks operate.

In demonstration of its sustainability leadership in the Nigerian banking sector, Access Bank championed the NSBP, which members of the Bankers’ Committee have since adopted and have achieved varying degrees of its implementation. The bank continues to promote the adoption of responsible banking in the Nigerian financial services industry.

The objective of the CBN Sustainability Awards is to acknowledge the efforts of financial services providers operating in Nigeria, who have successfully integrated social and environmental considerations into their business operations and activities in the year under review.

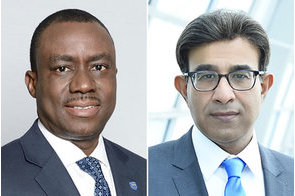

Speaking at the 2019 awards ceremony, which held at the 2019 Bankers Committee Gala Night in Ogere, Ogun State, Nigeria, Herbert Wigwe, Group Managing Director of Access Bank Plc, said the five awards won by Access Bank are a testament to the bank's commitment to sustainability. “Our vision is to be the world’s most respected African Bank and sustainability is critical to achieving this,” he said.

As part of its award-winning sustainability agenda, Access Bank has pioneered many innovative sustainability initiatives over the years. Some of these initiatives include the establishment of the first-ever disability-friendly inclusion hub, which expands access to information and communications technology (ICT) skills and opportunities to persons with disabilities. The hub was established in partnership with Project Enable, a digital inclusion community development initiative. In partnership with HACEY Health Initiative, Access Bank also created a digital, toll-free platform to address gender violence.

The bank has also launched various upcycling and recycling projects, among many other initiatives. Its upcycling and recycling initiatives have helped in transforming waste materials and other unwanted products into new materials that are more valuable products and have better environmental value. These initiatives have decidedly also helped in creating jobs.

“In our determined effort to offer more than banking, we will continue to set the standards for responsible business practices and demonstrate corporate brand commitment to addressing social, economic, and environmental issues,” said Omobolanle Victor-Laniyan, Access Bank’s Head of Sustainability.

The five CBN Sustainability Awards increased the number of Access Bank's trophies and plaques, which substantially grew in 2019. Other recognitions bestowed on the bank during last year include the Outstanding Business Sustainability Achievement Award at the 2019 Karlsruhe Sustainable Finance Awards; and Most Socially Responsible Company of the Year (Overall Winner) at the 2019 Sustainability, Enterprise and Responsibility Awards (SERAs). Access Bank also won Bank of the Year award at the 2019 Banker Awards; as well as Best Bank in Nigeria and Best Product Launch (Pan Africa) awards at the 2019 Europe, Middle East and Africa (EMEA) Finance Awards.

Martins Hile is Executive Editor, Financial Nigeria magazine

Related

-

African Development Bank offers FCMB $50 million credit line

The project is expected to improve access to finance for at least 50 enterprises: 29 in the agribusiness and manufacturing ...

-

Stanbic IBTC to become a sustainability-certified financial institution

Stanbic IBTC embarks on a holistic sustainability journey, begins implementation of global sustainability standards ... -

Certification programme for impact fund managers launches

Gold Standard said its requirements ensure best practice impact investing that builds on IFC safeguards, the UNDP Equity ...