Latest News

China charges higher interest rates on loans than World Bank - CGD report

News Highlight

Data includes loan-by-loan information on interest rates, maturities, and grace periods, including for projects that fall under China’s Belt and Road Initiative.

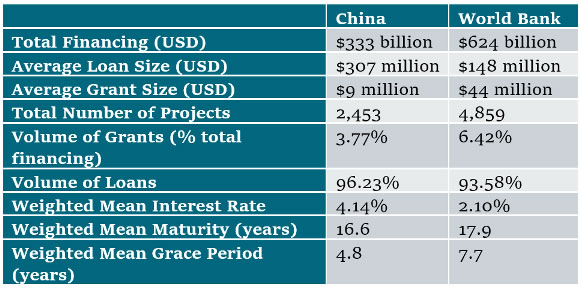

A new report from the Washington DC-based think tank, Centre for Global Development (CGD), finds that China's loans tend to have shorter grace periods and maturities and higher interest rates than loans from the World Bank.

The weighted mean interest rate for Chinese loans was 4.14%, approximately two times higher than 2.10% for the World Bank. Indicating World Bank loans are much more favourable, the volume of grants, as a percentage of total financing, for China’s loans was 3.77%. The data for the World Bank was 6.42%.

While the World Bank lends primarily to developing countries, China is now the biggest bilateral lender in the world. The report came as the Covid-19 economic crisis has caused rising concerns over debt sustainability in developing countries.

“With developing countries taking an economic hit from the Covid-19 pandemic, there’s a real concern about debt risks in developing countries – many of which were already at risk of debt distress,” said Scott Morris, a senior fellow at CGD and an author of the report. “China is now the largest bilateral lender in the world, so decisions made in Beijing have a huge impact on the economies of developing countries.”

In a statement on the report sent to Financial Nigeria, Brad Parks, the Executive Director of AidData and a co-author of the report, said the study found that China's loans have consistently contained harder terms than the World Bank, particularly for the poorest countries. He said most of the discussions of debt vulnerability in developing countries have focused on the overall amount of borrowing, but the shift in loan terms matters a lot too.

However, Parks said that “while we have concerns, we don’t find evidence for the ‘debt trap’ narrative. A few percentage points more in interest compared to the World Bank hardly seems usurious.”

According to Financial Nigeria’s further analysis of the data compiled for the study, provided by CGD, Nigeria borrowed a total of $21.17 billion from China and the World Bank between 2001 and 2014. Loans by the World Bank was 65.88% of the total amount, while China's loans accounted for 34.12%. Grants accounted for 1.09% of the total loans to Nigeria by China.

The loans by the World Bank were made from its concessionary IDA window, with interest rate at 0.0075%. Interest rates on China’s loans were largely unavailable. For those provided, interest rates ranged from 0.025 – 0.06%.

With a lack of official Chinese government data on its lending programmes, the researchers created a database of 2,453 loans from China and 4,859 loans from the World Bank for comparison, spanning 157 countries and 15 years. Data includes loan-by-loan information on interest rates, maturities, and grace periods, including for projects that fall under China’s Belt and Road Initiative.

“It's clear that developing country governments find value in China’s lending, compared to what they can get on the markets. But it's incredibly important that the Chinese government, which has a stated commitment to debt sustainability, carry out its lending programme in a way that doesn’t heighten debt risks in its partners,” said Morris.

Related News

Latest Blogs

- African banks can leverage intra-African trade if they fix governance gaps

- EFCC and when law enforcement becomes the terror

- How Tinubu Deviates from IMF/World Bank reform recommendations

- Naira commoditisation as CBN's cashless policy flaw

- Why Nigeria’s national DFIs must be recapitalised

Most Popular News

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Nigeria records 3.84 percent GDP growth rate in Q4 2024

- Obasanjo, other leaders to launch new debt relief initiative for Africa

- Atihad Airways to announce $1 billion IPO

- EIB backs Africa Finance Corporation $750m climate infrastructure fund

- Breaking News: Nigerian inflation eases to 24.5 percent after CPI rebasing