DFIs pledge $80 billion investments in African businesses over the next five years

Summary

DFIs play an important role in helping to build markets, mitigate risk and pave the way for other investors to enter new markets.

A group of international development finance institutions and DFIs from the G7 countries, on Monday, announced that they are committed to investing $80 billion in the private sector over the next five years to support sustainable economic recovery and growth in Africa.

The DFIs include the International Finance Corporation (IFC), the private sector arm of the African Development Bank (AfDB), European Bank for Reconstruction and Development (EBRD), and the European Investment Bank (EIB). The G7 DFI group consists of CDC, Proparco (France), JICA and JBIC (Japan), DFC (US), FinDev Canada (Canada), DEG (Germany) and CDP (Italy).

This is the first time the G7 DFIs have come together to make a collective partnership commitment to the African continent, amid the negative economic impacts of the COVID-19 pandemic. The IMF estimates that sub-Saharan Africa needs additional financing of around $425 billion between now and 2025 to help strengthen the pandemic response spending and reduce poverty in the region.

“The UK is proud to back this commitment by world leaders at the G7 Summit to invest more than $80 billion in Africa’s private sector over the next 5 years,” said The UK Minister for Africa, James Duddridge. “This investment will create jobs, boost economic growth, help tackle climate change and fight poverty. It comes at a crucial time as the continent rebuilds its economies, severely impacted by Covid-19.”

Nick O’Donohoe, the CEO of CDC Group, said the patient, high quality capital that DFIs provide is urgently needed if African economies are to start to rebuild quickly from the impact of the pandemic, adding that the CDC is committed to building long term investment partnerships in Africa that fuel sustainable private sector growth in support of the UN’s Sustainable Development Goals.

On his part, Werner Hoyer, President of the European Investment Bank, said the bank was ready to cooperate further with African and multilateral partners to tackle both COVID-19 and accelerate the green transition in Africa.

Other leaders of international DFIs who voiced their support for the new funding pledge include Makhtar Diop, IFC’s Managing Director; David Marchick, Chief Operating Officer, U.S. International Development Finance Corporation (DFC), Dario Scannapieco, Chief Executive Officer, Cassa Depositi e Prestiti (CDP); and Solomon Quaynor, AfDB Vice President, Private Sector, Infrastructure & Industrialization.

Quaynor, who was IFC Country Manager for Nigeria, said there was a further need to crowd-in African development partners, as well as African savings from SWFs, pensions, and insurance pools, estimated to have US$1.8 trillion AUM, given the gap between the IMF estimates and what this partnership is committing to. He said the opportunity to create jobs, particularly for the youth and women from a focus on industrializing Africa, which is underpinned by the African Continental Free Trade Area (AfCFTA), will be priority.

Each DFI has its own investment criteria which are aligned to an assessment of need to achieve development impact across a range of sectors. DFIs play an important role in helping to build markets, mitigate risk and pave the way for other investors to enter new markets.

Related

-

AfDB funds road construction to facilitate trade between Kenya and Uganda

AfDB said it approved $253 million to reconstruct a 118 km road section connecting the two countries.

-

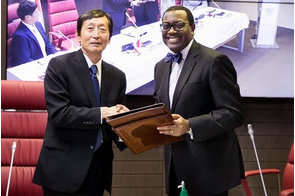

Japan provides $700 million to AfDB for concessionary lending

Ambassador Kawamura said he hopes the loans and grants will be used effectively to improve economic and social conditions ...

-

AfDB approves $120 million credit line for Tanzania’s CRDB Bank

The AfDB said the credit line will help the Tanzanian bank finance SME projects as well as infrastructure development.