Global Centre on Adaptation to Support Côte d’Ivoire on ESG projects

Summary

MoU aims to enhance and increase the share of adaptation and resilience investments financed by Côte d’Ivoire’s forthcoming EUR 2 billion Sustainable Bond Program.

The Global Centre on Adaptation (GCA), an international organization working as a solutions broker to accelerate action and support for adaptation solutions, today, signed a Memorandum of Understanding with the Ministry of Economy and Finance of the Republic of Côte d'Ivoire to enhance and increase the share of adaptation and resilience investments financed by the country’s forthcoming EUR 2 billion Sustainable Bond Program.

Côte d’Ivoire’s Nationally Determined Contributions (NDC) identifies 11 sectors vulnerable to climate change and estimates the total cost of implementing adaptation action to be USD 1.76 billion, GCA said in a statement it sent to Financial Nigeria.

The statement said GCA will support the French-speaking, West African country on ESG (Environmental, Social and Governance) projects identification, with a focus on climate change and adaptation related projects.

The intervention will be provided in two phases. The first and immediate support will see GCA providing technical assistance in the areas of budget screening and identification of eligible budget expenditures, within the scope of the ESG Framework of Cote d’Ivoire. And in the medium to long term, GCA will promote the implementation of the process and tools to classify climate change related expenditures, track climate-related expenditures in the national budget system (climate budget tagging), and train relevant government entities on these process and tools (including the ESG Committee).

“Through this work, GCA will be supporting the Government of Côte d'Ivoire to scale adaptation and resilience by leveraging the credibility, scale, momentum, and liquidity that the green bond market has achieved over the past ten years,” said Patrick Verkooijen, CEO of the Global Centre on Adaptation, on signing the MoU. “We hope, through our Africa Adaptation Acceleration Program, other countries across the continent will follow Côte d'Ivoire’s lead so the finance is in place to implement the necessary adaptation actions to secure the future of people’s lives and livelihoods across the continent”.

On his part, Adama Coulibaly, Minister of Economy and Finance, Côte d’Ivoire, said: “Our aim in issuing the first-ever sovereign sustainable bonds is in line with the climate policy commitment of His Excellency, President Alassane Ouattara to accelerate bold action on adaptation financing and resilience projects.”

Coulibaly added that public spending alone cannot meet the adaptation finance gap, so private sector investment must scale alongside government investments to supplement limited resources.

Côte d’Ivoire has formed an ESG Committee to select projects to be financed by the Sustainable Bonds. The ESG Committee is led by the Ministry of Economy and Finance, specifically the Department of Public Debt and Donations (“Direction de la Dette Publique et des Dons”). It includes representatives from the Ministry of Planning and Development, the Ministry of Budget, and from a range of sectoral ministries covering policies related to the Eligible ESG Categories, in particular, the Ministry of Environment and Sustainable Development, the Ministry of Health, the Ministry of Education, the Ministry of Energy, the Ministry of Hydraulics, and the Ministry of Solidarity and Fight against Poverty.

Related

-

US, Nigeria among top countries flaring gas

Nigeria achieved significant progress over the past 15 years, cutting its gas flaring by 70 per cent to just 7 bcm in 2020.

-

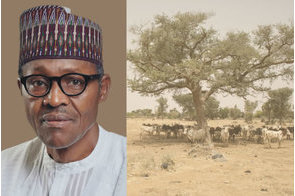

Why Buhari's tree planting initiative should be reconsidered

To reduce the impact of climate change, tree planting does not necessarily have to be widespread in grassland.

-

New handbook advances tropical weather forecasting in West Africa

The new handbook, facilitated by University of Leeds, could help safeguard lives and resources in West Africa.