Olusola Dahunsi, PhD, Lecturer, KolaDaisi University

Subjects of Interest

- Development Finance

- Fiscal Policy

- Public Sector Reform

How to fight Nigeria’s hyperinflation 15 Nov 2023

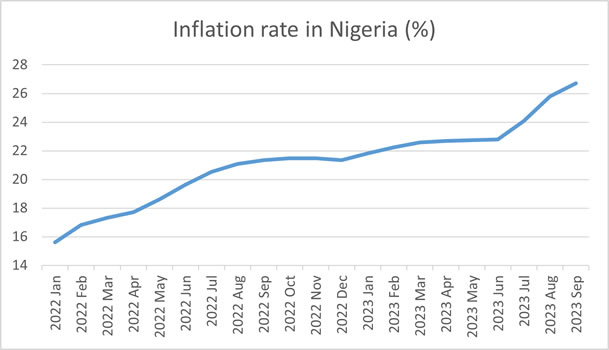

According to the World Bank's Global Economic Prospects Report (2022), an ideal inflation rate of 2.5 percent for developed economies and 3 percent for developing countries would be achieved by the end of 2023. However, the inflation rate in Nigeria has increased by over 11 percentage points from 15.60 percent in January 2022 to 26.70 percent in September 2023, according to data from the National Bureau of Statistics (NBS). The end is not yet in sight for the current cycle of high inflation in the country.

The rising trend in inflation in Nigeria is hurting the economy by eroding the purchasing power of Nigerians, making it more difficult for the poor to afford essential goods such as food, housing, education, and healthcare. It is also preventing many SMEs from operating profitably, thereby hurting job creation.

Disaggregating the consumer price index, NBS data shows that between January and September 2023, core inflation – which excludes goods with volatile prices such as food and fuels – steadily rose from 17.2 percent to 21.84 percent, and food inflation increased from 25 percent to 30.64 percent. The Northern region of the country, where most agricultural production occurs, experienced even higher food price inflation. And while rural inflation has exceeded 30 percent in many states in the region, the prices of goods and services like housing and transport have surged in most of the urban cities to 28.68 percent.

As is usually the case, these higher inflation rates have been especially damaging to the poor and vulnerable. These people are often less able to afford price increases and are more likely to work in the informal economy where incomes and salaries are often lower and less likely to be indexed to inflation.

Several factors have contributed to Nigeria's growing inflation rates in recent times, ranging from external and internal risks to internal structural challenges. The persistent rise in the prices of energy and food commodities globally, the attendant supply chain interruptions due to the COVID-19 pandemic, and the Ukraine-Russia crisis are some of the external factors that have impacted the prices of goods and services in Nigeria. However, the Nigerian economy is also beset by several structural issues including overdependence on foreign exchange revenue from crude oil and a weak manufacturing base. The recent removal of petrol subsidies and introduction of market exchange rate policy have combined with long-term factors including infrastructure deficits and insecurity – which greatly affects farmers and frustrates efforts to stimulate economic activities – to trigger hyperinflation in the country.

The NBS data confirms the high inflationary impact of the policies of President Bola Tinubu who came into office on 29 May 2023. Between June and September this year, the inflation rate jumped by approximately 4 percentage points, from 22.79 to 26.70 percent. Despite this negative impact of his policies in the immediate term, the administration has to support a downward trend of inflation over the long run.

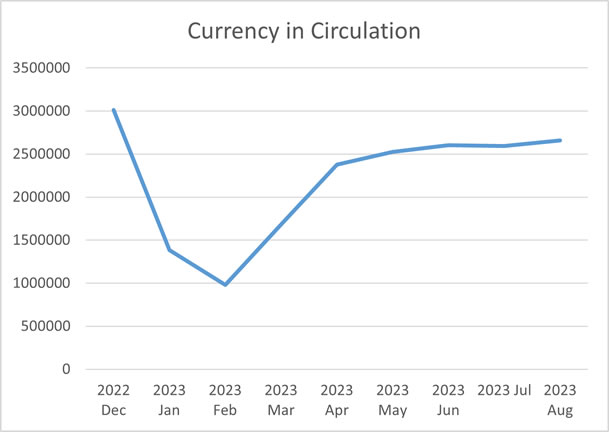

The main responsibility for achieving price stability is with the Central Bank of Nigeria (CBN), through its control of money supply and setting of interest rate. The money supply increased steadily during the tenure of Godwin Emiefele as CBN governor. The currency in circulation grew by 80 percent from N1.67 trillion in May 2015 to N3.01 trillion in December 2022, as per CBN’s Money and Credit Statistics. This is attributable to the poor management and operations of the bank, which was characterised by the incessant printing of money as the then government relied heavily on direct borrowing from the CBN to fund its budget deficits. The over-use of the CBN’s Ways and Means Advances to the government saw the balance of the account increase from N590 billion in April 2015 to N22.7 trillion in December 2022.

The CBN had wanted to address the naira liquidity surfeit by changing the currency. However, due to the poor implementation of the plan, the money in circulation only reduced from its level at the end of last year to N982 billion in February 2023. The naira redesign was wittingly or unwittingly tied to the last electoral cycle. Since the February 2023 general elections, the money supply has continued to increase, reaching N2.66 trillion this past August. The CBN, under its current leadership, must avoid its past mistakes while the government must support independent and sound monetary policymaking by curtailing its borrowing from the reserve bank. Overall fiscal prudence is necessary to reduce the upward pressure on prices.

Despite the current demand pressure that is driving up the exchange rate of the naira, the current reform targeted towards the unification of rates in the official and parallel markets is a good step in the right direction. By reducing speculation on the value of the national currency, the reform will help stabilise the value of the naira in the longer term, with the effect of stabilising the prices of goods – both foreign- and locally-produced.

The CBN must be courageous in enacting a tighter monetary policy. Most central banks, including the US Fed and the European Central Bank, aggressively raised interest rates to curb growth in inflation in their jurisdictions. This was done despite their awareness of the risk posed by the policy strategy to economic growth. The timeliness of such intervention and the management of the associated risk through other measures are proving to be effective – although global economic conditions remain concerning.

For Nigeria, any consideration for interest rate hikes must factor in the large contribution of the removal of subsidies on petrol and market exchange rate. The impacts of these policies may linger – especially if oil prices remain above $90 per barrel or higher – and blunt the potential impact of interest rate increases in slowing price growth. An additional consideration on imported inflation is the likely continuation of supply shocks to food and energy, given lingering and new untoward geopolitical events – including the Russia-Ukraine war and the tension in the Middle East. So far, inflation has trended upward as the CBN has increased its Monetary Policy Rate. This leaves the reserve bank with a money supply as its veritable tool for fighting inflation.

The so-called loan-for-infrastructure policy of the past administration contributed in large part to the inflationary environment. The current administration should, therefore, more carefully rationalise its expenditure, prioritising key productive sectors that would spur economic growth. In this regard, significant public investments should be allocated to directly and effectively support the agriculture and manufacturing sectors to improve the domestic supply of food and other essential consumer goods.

To deliver on its onerous responsibility of price stability, the CBN needs public and investor confidence. This will come about only if it is perceived to be independent of political control. Therefore, the best way for the government to support this core mandate of the central bank is to not interfere with its policymaking directly or indirectly by making the CBN its automated teller machine like its predecessor did.

Olusola Dahunsi, PhD, who is a chartered accountant, is a lecturer and researcher.

Latest Blogs By Olusola Dahunsi, PhD

- CBN is fighting inflation instead of stagflation

- Challenges and opportunities of exits of MNCs from Nigeria

- 2023 as year of policy instability in Nigeria

- How to fight Nigeria’s hyperinflation

- First aid and sustainable treatment for fuel subsidy removal shocks