Latest News

IFC announces four new projects to support MSMEs

News Highlight

The projects will help businesses address food insecurity across the African continent and trade financing gaps and will support increased agricultural productivity and efficiency.

International Finance Corporation (IFC), on 23 June 2023, announced four new projects to support micro, small, and medium-sized enterprises (MSMEs) in Africa and globally. The projects will help businesses address food insecurity across the African continent and trade financing gaps and will support increased agricultural productivity and efficiency.

Announced at an event held by the Alliance for Entrepreneurship in Africa on the sidelines of the Summit for a New Global Financing Pact in Paris, France, IFC said the projects underscore its commitment to supporting smaller businesses, job creation, and private sector development.

The new projects include the MSME Finance Program, a multi-year initiative that will provide up to $5 billion in financing to create increased capital and to mobilise financial markets as greater sources of development finance globally. Specifically, the program will increase lending to women entrepreneurs, MSMEs contributing to food security, first-time MSME borrowers, and MSMEs in vulnerable regions affected by climate change. It will support MSMEs in fragile and conflict-affected situations as well as those in Middle-Income Countries (MICs). Through the program, IFC will earmark $250 million to fund the resilience and protection of MSMEs in small island nations.

The Africa Agriculture Accelerator Programme will provide financing to agribusiness companies to support their growth and expansion and ultimately foster more local food production and contribute to greater food security. Through the programme, IFC said it will finance up to $1 billon and reach up to one million hectares of land over the next three years.

The EBRD Pilot Start-Up Project, announced in partnership with EBRD, will facilitate increased capacity building, mentoring, networking, and funding for early-stage enterprises, incubators, accelerators, and seed funds in North Africa. The fourth programme, the Risk Distribution Partnership, will help facilitate greater access to sustainable trade finance for emerging African markets and develop deeper intra-Africa trade. Through the partnership, Proparco will participate for up to $500 million in IFC’s Global Trade Finance Program (GTFP).

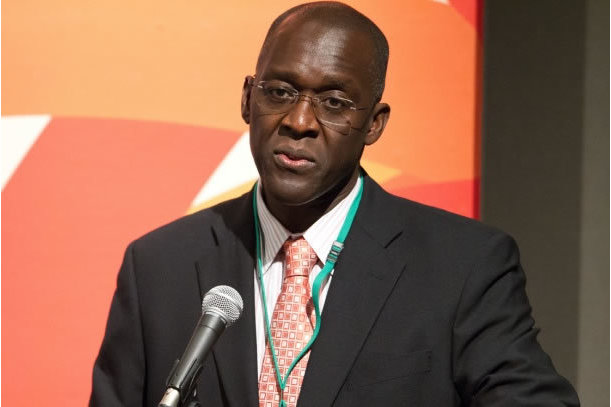

“We are pleased to announce these new projects as part of our ongoing commitment to support MSMEs, including through the Alliance for Entrepreneurship in Africa. These initiatives will help to increase access to finance, improve productivity, and build resilience for MSMEs, which are critical for economic growth and job creation,” said IFC's Managing Director Makhtar Diop.

Related News

Latest Blogs

- The Museum of West African Art saga

- The complexity and complication of Nigeria’s insecurity

- Between bold is wise and wise is bold

- Prospects of port community system in Nigeria’s maritime sector

- Constitutionalism must anchor discipline in Nigerian Armed Forces

Most Popular News

- NDIC pledges support towards financial system stability

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- ChatGPT is now the most-downloaded app – report

- Green economy to surpass $7 trillion in annual value by 2030 – WEF

- CBN licences 82 bureaux de change under revised guidelines

- Africa needs €240 billion in factoring volumes for SME-led transformation