International investors launch climate endowment fund

Summary

The fund aims to support the green revolution championed by #FridaysForFuture, the global youth climate change movement.

A group of five investors and entrepreneurs, including Wermuth Asset Management GmbH (WAM) – an international investment advisory firm in Germany, has announced the launch of a new climate endowment as a response to the climate crisis and outcry for a green revolution in Europe. The fund will focus on illiquid investments in sustainable and commercially-viable technologies and business models aimed at drastically reducing carbon dioxide (CO2) emissions.

The aim of the climate endowment fund is to provide investment opportunities for large institutional investors such as pension funds, insurance companies and sovereign wealth funds to invest in low-carbon or green projects. According to a statement released on Wednesday, the fund will enable institutional investors to allocate more of their huge capital stock in renewable energy, new mobility, and related cleantech assets. The fund aims to support a green revolution across several sectors, including energy, transport, finance, agriculture, artificial intelligence, information technology, education and health.

“The shifting tide of public opinion on climate protection has reached a critical mass – the recent EU elections, as well as the unprecedented ‘Friday for Future’ protests, have signalled a clear demand for green revolution,” said Jochen Wermuth, Founding Partner at WAM and initiator of the climate endowment. “I believe there has never been a better time than now for the investment community to step forward and initiate this change.”

#FridaysForFuture is a school climate strike, which began in August 2018, after then-15-year-old Greta Thunberg sat in front of the Swedish parliament every schoolday for three weeks, to protest against the lack of action on the climate crisis. By September, she decided to continue striking every Friday until the Swedish government took decisive policy actions to tackle global warming in line with the Paris Agreement.

The school strike soon became a global movement, which was formed in November of last year. Tens of thousands of people across Europe and elsewhere have joined the movement.

The climate endowment fund will be officially launched in the fourth quarter of 2019. The founding members plan to secure the commitment of the public and private sector to achieve an endowment size between €20 billion and €40 billion.

The other initiators of the climate endowment are AQAL AG, a Munich-based exponential-tech holding company; Markus Bodenmeier, Co-founder of AQAL AG; Patrick Horend, an investment analyst and risk manager at Abu Dhabi Investment Council. The fund is supported by a group of advisors and supervisory board members, including Mats Andersen, former CEO of AP4 – fourth Swedish National Pension Fund; Stephen Blyth, former CEO of the Harvard Endowment; Philippe Défossès, former CEO of ERAFP (French Public Service Additional Pension Scheme).

According to Mariana Bozesan, Co-founder and board member of AQAL AG, the fund is the most significant stepping stone to achieving the United Nations Agenda 2030, which has only 11 years left for its fulfilment. “We are convinced that the transformation is feasible,” she said.

Related

-

Multilateral treaty bans illegal timber export from Nigeria

EIA estimates more than four million trees worth roughly half a billion dollars were cut down in Nigeria from January 2017 ...

-

The arctic comes in from the cold

This summer, a century-old sailing ship, the Sedov, traversed the NSR without seeing any ice at all.

-

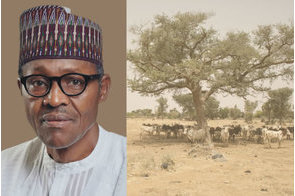

Why Buhari's tree planting initiative should be reconsidered

To reduce the impact of climate change, tree planting does not necessarily have to be widespread in grassland.