Nigerian power sector: resolving liquidity concerns

Feature Highlight

Given financial pressures on the power generation companies and distribution companies, upward tariff revisions across customer bands (i.e. possibly in the form of partial or full removal of electricity subsidies) are likely in 2025.

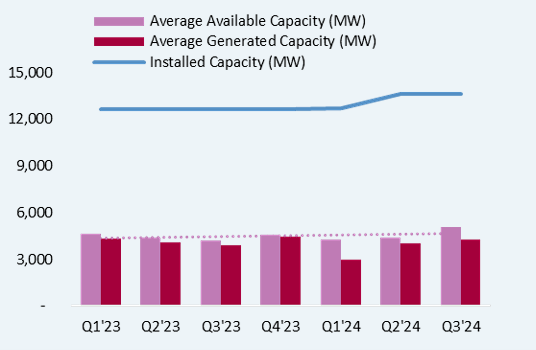

Although the power sector installed capacity was mostly flat year over year in 2024, the average energy generated improved by a marginal 2.2% to 4,280 MW in Q3'24 from 4,189 MW in 2023. This improvement was in spite of the challenges of grid collapses, infrastructure vandalism, liquidity constraints, and gas supply shortages in the period. In 2025, structural reforms and market-driven efficiencies are expected to reshape the sector. Notably, the shift to bilateral trading should allow generation companies (GenCos) to sell power directly to distribution companies (DisCos), easing liquidity pressures and improving cash flow. Further tariff adjustments are also on the cards as the government looks to reduce electricity subsidies, while other initiatives aim to close the metering gap and improve revenue collection.

Elsewhere, rising gas prices and supply constraints may pressure GenCos' margins, but grid investments under the Presidential Power Initiative (PPI) and the state-level market decentralisation are expected to enhance long-term stability. Additionally, renewable energy adoption, driven by government policies and financing initiatives, should further improve the sector's outlook.

Bilateral trading transition to drive efficiency and capacity expansion

In July 2024, the Nigerian Electricity Regulatory Commission (NERC) issued the "Order on the Transition to Bilateral Trading in the Nigerian Electricity Supply Industry (NESI)," marking a shift from a centralised bulk trading system to a competitive bilateral market. This reform is designed to enhance market competition by reducing the role of the Nigerian Bulk Electricity Trading (NBET) Plc as the intermediary and allowing GenCos to engage directly with DisCos.

A key feature of this transition is the adoption of "take-or-pay" contracts, which guarantee payments for off-take obligations, fostering market certainty and discipline. This mechanism allows DisCos to optimise energy procurement and enhance supply quality. However, NBET may continue managing long-term contracts with select GenCos, including Azura, Omotosho, Olorunsogo, Agip, and Shell, which will either run their course or be renegotiated.

This strategic reform aims to foster a more competitive and efficient electricity market in Nigeria, reduce the government's fiscal exposure to market risks, and encourage direct contractual relationships between electricity producers and distributors. The move would also address the industry's persistent liquidity challenges, which resulted in GenCos receiving less than 40.0% of their FY'24 power supply invoices. This is reflected in the N267.0 billion combined receivables of Transcorp Power and Geregu Power (+87.2% YoY), which strained their cashflows.

Notwithstanding the liquidity crisis, the average available capacity rose by 12.3% from December 2023 to Q3'24. The traction on available capacity would have been better if the liquidity issues had been resolved and fresh investments had been made in the sector.

The introduction of bilateral contracts, supported by the supplementary Multi-Year Tariff Order (MYTO), also offers significant growth potential for power-generating companies like Transcorp and Geregu. These reforms are expected to support revenue stability, improve cash flow management, strengthen cost recovery, and incentivise capacity expansion.

Figure 1: Nigeria is currently underutilising installed capacity in the power sector

Source: NERC, CardinalStone Research

Multiple metering initiatives to enhance power distribution

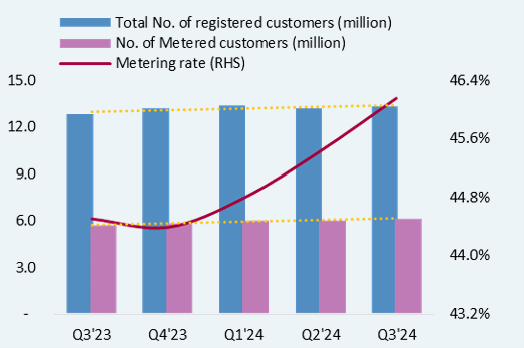

As of September 2024, approximately 46.2% of the 13.3 million registered electricity customers across the 12 DisCos had been metered – up from 44.5% in Q3'23. In Q3'24, the number of meters installed rose by 256.0% QoQ to 184,507, largely driven by the Meter Asset Provider (MAP) framework, which accounted for 96.9% of installations.

This progress has improved revenue collection efficiency, with DisCos collecting N1.19 trillion of the N1.54 trillion billed as of the first nine months of 2024, reflecting a 77.3% collection efficiency. Since DisCos are the primary revenue collectors in the electricity value chain, their ability to collect and remit payments to NBET or directly to GenCos is vital for maintaining sector liquidity.

To sustain the positive momentum and address the metering gap, the Nigerian government, through the Ministry of Power and NERC, has introduced the initiatives below:

1. The Meter Acquisition Fund (MAF): In June 2024, the NERC introduced the Meter Acquisition Fund (MAF) to address a metering deficit exceeding 7 million customers. The MAF allows DisCos to access long-term financing for meter acquisition and deployment.

2. The Presidential Metering Initiative (PMI): In November 2023, President Bola Ahmed Tinubu approved the Presidential Metering Initiative (PMI) to bridge Nigeria's metering gap and improve power sector efficiency. At its inception, the PMI aimed to deploy over 5 million smart meters by 2027 to eliminate estimated billings.

The federal government earmarked N700 billion for the initiative, funded through monthly deductions from the federation account, with N420 billion saved as of August 2024. The plan aims to distribute 2 million meters annually, with the first batch expected in Q1'25.

3. The World Bank-funded Distribution Sector Reform Program (DISREP): Launched in February 2021 with $500 million in initial funding, DISREP is a World Bank-supported initiative under the Federal Government’s Power Sector Recovery Programme (PSRP) to revitalise Nigeria’s electricity distribution sector. In June 2023, the World Bank approved additional financing to strengthen the PSRP, improve distribution performance, attract private investment, and ensure reliable, affordable electricity. Aided by DISREP, the Minister of Power, Adebayo Adelabu, announced the procurement of 1.3 million meters in 2024, noting that deployment of the meters will be between December 2024 and Q2’25.

Figure 2: Improvements in metering rate (%) in 2024

Source: NERC, CardinalStone Research

Pressure from gas cost to subsist in 2025

Gas-fired power plants account for 70.0%–80.0% of Nigeria's electricity generation, but consistent supply remains a challenge due to GenCos' liquidity issues and suppliers' concerns over pricing. These issues have forced gas suppliers to prioritise international LNG markets over domestic commitments, a situation that has created significant setbacks for the power value chain. To address the pricing issue and improve gas availability, the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) raised the natural gas price for GenCos from $2.18 to $2.42 per Metric Million British Thermal Unit (MMBtu) in April 2024. This decision resulted in a significant increase in the operating costs for power-generating companies such as Transcorp Power and Geregu Power, both of which saw gas expenses exceed 80.0% of the cost of goods sold (COGS) in FY'24, squeezing profit margins.

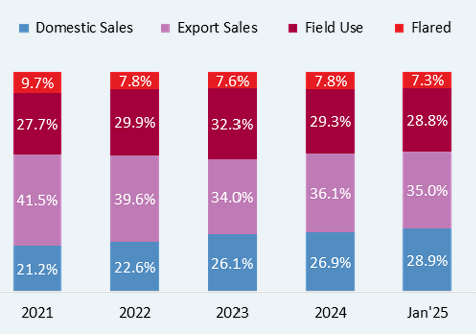

Despite the increase, domestic gas prices are lower relative to prices in Ghana, South Africa, and Egypt. We see latitude for further price hikes as the NMDPRA seeks to make prices competitive, incentivise upstream producers, and address domestic supply challenges. Elsewhere, gas availability for domestic use can be improved by a strategic clampdown on gas flaring, which sees circa 8.0% of total gas output go to waste on an annual basis, given data over the last five years.

Figure 3: c.28.9% of gas output is domestically consumed

Source: NUPRC, CardinalStone Research

Possible tariff review in 2025

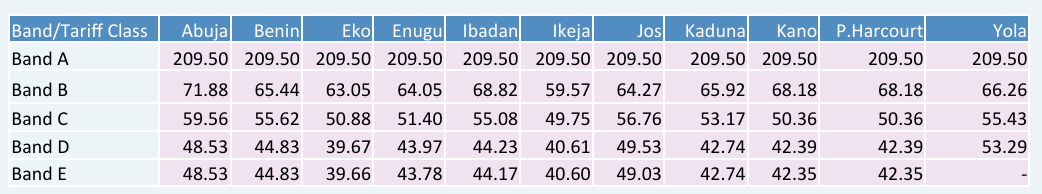

The NESI’s cost-reflective tariff framework allows for periodic adjustments based on economic conditions. Given financial pressures on GenCos and DisCos, upward tariff revisions across customer bands (i.e. possibly in the form of partial or full removal of electricity subsidies) are likely in 2025. Already, the NERC has eliminated electricity subsidies for customers under the Band A classification resulting in a tariff increase from N66.00 per kilowatt hour (kWh) to N209.50/ kWh currently. This adjustment aimed to alleviate the substantial financial burden on the government, which, as of November 2024, had expended approximately N1.90 trillion on electricity subsidies, with projections indicating that this figure may have escalated to N2.40 trillion by the end of 2024.

For the remaining electricity bands, the Federal Government has announced plans to regularise the electricity tariffs, citing the current inequitable tariff gap between band A and other band classes. Ultimately, we expect a gradual shift to fully cost-reflective tariffs over three years, with the transition to this framework starting in 2025.

Figure 4: Average tariff (N/Kwh) across DisCos as of July 2024

Source: NERC, CardinalStone Research

Figures in Figure 8 capture average tariffs across MD-1, MD-2, and Non-MD.

MD-1: LV Maximum Demand connection (commercial and small industrial)

MD-2: MV/HV Maximum Demand (11/33kv) connection (large commercial and industrial). (Only Abuja and Ikeja discos have an A-MD2 Special tariff class for bilateral power customers.)

Non-MD: Single or three-phase connections (residential and small commercial shops).

More state-led electricity markets to be established in 2025

In 2024, the NERC initiated the transfer of regulatory oversight to state governments in line with the 2023 Electricity Act, which permits states to regulate intra-state electricity activities. On the 10th of January 2025, NERC commenced the transfer of regulatory oversight to 10 states: Enugu, Ekiti, Ondo, Imo, Oyo, Edo, Kogi, Lagos, Ogun, and Niger. The transfers have been completed for four states – Enugu, Ekiti, Ondo, and Imo – while the remaining six are in progress.

In 2025, we expect more states to establish their electricity markets, enabling tailored solutions for local generation and distribution. This decentralisation aligns with the government’s goal to improve efficiency within the NESI.

Grid-targeted initiatives and investments to bear fruits in mid to long-term

The 12 national grid collapses in 2024 were caused by ageing infrastructure, insufficient investment, poor maintenance, vandalism, and power imbalances. According to NERC, the grid operates within voltage (330kV ± 5.0%) and frequency (50Hz ± 0.5%) limits – deviations can cause power degradation or blackouts.

In response to concerns over grid collapses, the Federal Government and the Transmission Company of Nigeria are implementing a comprehensive grid overhaul supported by the Presidential Power Initiative (PPI) and partnerships with the World Bank and African Development Bank. Elsewhere, as the Electricity Act promotes decentralisation, we expect the rise of state-operated grids, reducing reliance on the national grid and improving system stability.

Growing development in renewable energy

The Renewable Energy Master Plan (REMP) seeks to elevate the share of renewables – such as wind, solar, biomass, and small hydro – in Nigeria's energy mix to 23.0% by 2025 (vs 21.0% in 2023). Meanwhile, the Nigerian Energy Transition Plan (ETP) outlines a strategic roadmap to expand renewable energy capacity, reduce reliance on fossil fuels, and achieve net-zero emissions by 2060. To realise these ambitious goals, the ETP estimates a required investment of $1.9 trillion (by 2060), which is $410 billion above the typical spending estimate.

Given these significant financial needs, the government and Development Finance Institutions (DFIs) will likely introduce new funding schemes to accelerate renewable energy adoption. Elsewhere, in September 2024, the World Bank approved a $1.57 billion loan for Nigeria, including $500 million for the Sustainable Power and Irrigation Project.

Stephen Chima, Adebayo Adebanjo, ACA, and Philip Anegbe, CFA, are research analysts at CardinalStone Research.

Please click this link to view the full report and disclosures.

Other Features

-

-

What I learned after studying 80 innovation programmes in Africa

My team and I are in the process of designing an innovation and entrepreneurship programme which we hope accelerates ...

-

India has arrived

A founder of the Non-Aligned Movement, India has plenty of experience navigating precarious ...

-

The new CBN foreign exchange code and its implications

With the introduction of the CBN FX code, Nigeria has aligned with leading financial jurisdictions, such as the ...

-

FIRS: Tax revenue as Nigeria’s new ‘crude oil’

President Tinubu deserves to be hailed for the huge jump in the shareable FAAC allocations which has continued an ...

-

DeepSeek and the future of finance

The DeepSeek disruption is a clear signal that the AI landscape in financial services is about to undergo a seismic ...

-

How to sell USDT for cash in Nigeria: A comprehensive guide

Selling USDT for cash in Nigeria doesn’t have to be complicated.

-

A review of the national tax bills

The four tax bills signify a pivotal shift in Nigeria’s tax framework, focusing on critical areas of revenue ...

-

How Tinubu Deviates from IMF/World Bank reform recommendations

President Tinubu should not only adopt IMF’s policies, but he should also heed the recommendations for ...

Most Popular News

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Nigeria records $6.83 billion balance of payments surplus in 2024

- Tariffs stir inflation fears in US but offer targeted industry gains ...

- Tinubu appoints new Board Chair, Group CEO for NNPC Limited

- Soaring civil unrest worries companies and insurers, says Allianz

- CBN net reserve hits $23.1 billion, the highest in three years