NSBP hosts conference on Sustainability Standards

Summary

SSCI facilitates and advances an economy that works within the planetary boundaries and does not erode or destroy the very ecosystems upon which it fully depends.

In an effort to draw from the experiences of banks certified under the Sustainability Standards and Certification Initiative (SSCI), the Nigerian Sustainable Banking Principle (NSBP) Steering Committee, chaired by Access Bank PLC, last month hosted an e-conference themed “Sustainability Standards for Value-Based Financial Institutions.” The virtual conference held in partnership with the European Organisation for Sustainable Development (EOSD).

In her opening remarks to the participants, the Special Adviser to the Governor of the Central Bank of Nigeria (CBN) on Sustainable Banking, Aisha Usman Mahmood, acknowledged the importance of sustainability standards. She said Nigerian financial institutions are opportune to have the NSBP framework, which enables the integration of environmental, social and governance (ESG) practices into lending and investment decision-making. Dr. Mahmood noted that, “the SSCI’s cutting-edge sustainability standards would be an enabler for creating strong, value-driven and profitable financial institutions.”

In September 2020, Access Bank became the first African commercial bank to be sustainability certified under SSCI. The bank was among the first set of banks, across commercial banking, development finance, non-bank financial institution and microfinance, and across Africa and Asia, to be certified.

While sharing her experience from the implementation of the standards by Access Bank, the Head of Sustainability at the bank, Omobolanle Victor-Laniyan, said: “SSCI is not the same as other principles or standards we have obtained. Embracing the SSCI and adopting the standards have brought us closer to where we desire to be as a bank.”

Ms. Victor-Laniyan said Access Bank makes sustainability the standard in all the markets where it operates. According to her, the SSCI has had a transformational impact on Access Bank, adding that, “SSCI ensures you do things right and you are committed to them regardless of where you are on your sustainability journey.”

Ms. Victor-Laniyan also challenged other Nigerian financial institutions to join the certification process of SSCI. According to her, the sustainability standards has enhanced the leadership of Access Bank in sustainability and strengthened its advocacy in the financial ecosystem.

Arshad Rab, the Chairman of the International Council on Sustainability Standards, and CEO of EOSD, delivered the keynote address at the conference. He said that having more financial institutions adopt the sustainability standards would lead to economies that work for businesses and societies alike, including those who have been historically marginalized.

Mr. Rab said SSCI facilitates and advances an economy that works within the planetary boundaries and does not erode or destroy the very ecosystems upon which it fully depends. He said such an economy is resilient to shocks, builds and maintains strong economic fundamentals, harnesses emerging disruptive technologies, and makes the Fourth Industrial Revolution work for both developing and industrialized nations. He underscored the role of “value-based” financial institutions in such an economy.

Leaders in financial institutions, especially those that are already SSCI-certified, and representatives of the implementing institutions gave presentations to share their experience. Jesimen Chipika, Deputy Governor, Reserve Bank of Zimbabwe (RBZ), underscored the role of banking regulators in facilitating the adoption of sustainability standards. A member of the International Council on Sustainable Standards, Dr. Chipika described the steps being taken by the RBZ to ensure a critical mass of Zimbabwe’s banks adopt SSCI.

On his part, Patricia Ojangole, Deputy Chairman, Association of African Development Finance Institutions (AADFI), and CEO of Uganda Development Bank, which is SSCI-certified, spoke on how the sustainability standards has helped to strengthen UDB’s institutional purpose and impact goals that are geared towards various development targets for the benefit of the Ugandan people and economy.

Romani Da Silva, Deputy Chairman and Managing Director, Alliance Finance Company PLC, Sri Lanka, also SSCI-certified, spoke about the resilience that has been fostered in his institution following its certification. He said the AFC has been able to attract new impact funding as a sustainability-centric financial institution.

Lolade Awogbade, Assistant Vice President and Sustainability Specialist, Development Bank of Nigeria PLC; and Ifeoma Uz’okpala, Group Head, ESG and other Non-Financial Risks, Bank of Industry Limited, both shared their ongoing experience in signing up to and implementing the SSCI standards in their institutions.

The NSBP Steering Committee is the guiding body for the adoption of sustainability-driven initiatives and processes in Nigeria’s financial ecosystem. The e-conference was co-moderated by Ms. Victor-Laniyan and Jide Akintunde, Managing Editor, Financial Nigeria, and the Representative of the European Organisation for Sustainable Development in Nigeria.

Related

-

EIB issues its first ever digital bond on a public blockchain

The €100mn 2-year bond is the first primary issuance of digitally native tokens using public blockchain technology.

-

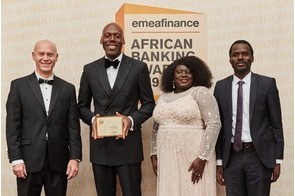

Access Bank receives awards for innovation and financial performance

Access Bank won Bank of the Year Nigeria at The Banker's Awards, as well as Best Bank in Nigeria and Best Product Launch ...

-

Whistleblower protection crucial for anti-graft in banking

Passing the Whistleblower Protection Bill into law would assist in the anti-corruption drive of the current ...