Latest News

UNCTAD says $89 billion leaves Africa annually in illicit financial flows

News Highlight

A comparison of IFFs from Africa and the continent's total external debt showed Africa is a net creditor to the world.

The Economic Development in Africa Report 2020, by the United Nations Conference on Trade and Development (UNCTAD), says stopping illicit capital flight could almost cut in half the annual financing gap of $200 billion that the African continent faces in achieving the Sustainable Development Goals (SDGs). The report says an estimated $88.6 billion, equivalent to 3.7 per cent of Africa’s GDP, leaves the continent as illicit capital flight every year.

According to the report, these outflows include illicit capital flight, tax and commercial practices like mis-invoicing of trade shipments and criminal activities such as illegal markets, corruption or theft.

Illicit financial flows (IFFs) are movements of money and assets across borders which are illegal in source, transfer or use, according to the report entitled “Tackling illicit financial flows for sustainable development in Africa.” The report says the outflows are nearly as much as the combined total annual inflows of official development assistance, valued at $48 billion, and yearly foreign direct investment, pegged at $54 billion, received by African countries – the average for 2013 to 2015.

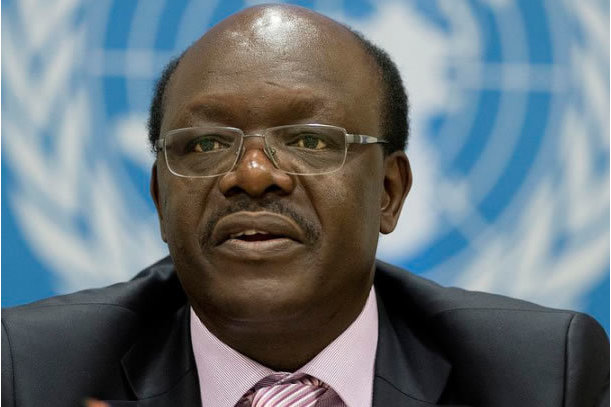

“Illicit financial flows rob Africa and its people of their prospects, undermining transparency and accountability and eroding trust in African institutions,” said UNCTAD Secretary-General Mukhisa Kituyi.

From 2000 to 2015, the total illicit capital flight from Africa amounted to $836 billion. Compared to Africa’s total external debt stock of $770 billion in 2018, this makes Africa a “net creditor to the world”, the report says.

The report finds that tackling capital flight and IFFs represents a large potential source of capital to finance much-needed investments in, for example, infrastructure, education, health, and productive capacity.

The report’s analysis also demonstrates that IFFs in Africa are not endemic to specific countries, but rather to certain high-value, low-weight commodities. Of the estimated $40 billion of IFFs derived from extractive commodities in 2015, 77% were concentrated in the gold supply chain, followed by diamonds (12%) and platinum (6%), the report highlights, offering new insights for researchers and policymakers studying how to identify and curb IFFs. The report says this is relevant to all gold-exporting countries in Africa, for example, despite their differing local conditions.

The report canvasses international solutions to IFFs, and quoted Nigerian President Muhammadu Buhari to have said “Illicit financial flows are multidimensional and transnational in character. Like the concept of migration, they have countries of origin and destination, and there are several transit locations. The whole process of mitigating illicit financial flows, therefore, cuts across several jurisdictions.”

Related News

Latest Blogs

- What Ould Tah’s tenure at BADEA reveals about his AfDB candidacy

- Implementation strategy crucial for the success of 12-4 education policy

- A senator’s suspension threatens the right of representation

- Tinubu’s promising revolution in infrastructure development

- Has Tinubu’s economic reform started working?

Most Popular News

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- Nigeria records $6.83 billion balance of payments surplus in 2024

- Tariffs stir inflation fears in US but offer targeted industry gains ...

- Tinubu appoints new Board Chair, Group CEO for NNPC Limited

- CBN net reserve hits $23.1 billion, the highest in three years

- Soaring civil unrest worries companies and insurers, says Allianz