Visa to accelerate financial inclusion in Nigeria with mobile payment

Summary

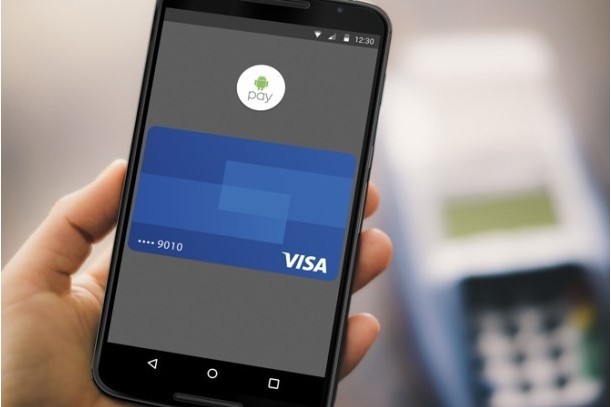

mVisa allows informal traders to accept electronic payments without the need for POS terminals.

Visa Inc., the global payments technology company, has said it is in advanced discussions with some Nigerian banks to roll-out its mobile payments solution, mVisa, in the country before the end of 2016.

With mVisa, consumers can pay for goods by scanning a QR code – a mobile phone-readable barcode – on a smartphone or by entering a merchant number into a feature phone. Once this is done, payment goes straight from the consumer’s Visa account into the merchant’s account and both parties receive real-time notifications.

“We’re excited by the prospects of mVisa for Nigeria as a mobile payment solution which brings real benefits to drive digital transformation,” said Ade Ashaye, Group Country Manager for Visa West Africa. “Because mVisa allows merchants to accept Visa payments without having to invest in costly point of sale hardware, it gives Nigerian consumers a reliable, secure and convenient mobile payment option.”

According to a statement released on Tuesday, Visa said the solution is designed to accelerate financial inclusion in Nigeria in line with the objective of the Nigerian government and Visa's commitment to the World Bank to extend e-payments to 500 million people globally by 2020.

As of June 2016, the Nigerian Communications Commission reported that there are close to 150 million connected telephone lines in Nigeria. Visa said the mobile payment solution will be available for both smartphone users and consumers using basic feature phones.

The global payments technology company also said merchants and banks also stand to benefit from the mVisa. Consumers can use mVisa agents for domestic remittances and also to access their cash where there is no ATM network.

Recent data provided by the Ministry of Budget and National Planning reveal that the Nigerian informal sector contributes about 58 percent to the national economy. The informal economy represents economic activities that are often cash-based and go unreported. Visa says mVisa allows informal traders to accept electronic payments in a cost-effective way, without the need for point of sale (POS) terminals.

Merchants are able to receive payments directly into their bank account within minutes of a consumer making a payment. The mobile payment solution also supports handling of refunds and chargebacks for consumers, unlike other payment solutions.

“As a bank committed to bringing unrivalled customer experiences, we’re incredibly excited about mVisa and its potential for our customers in Nigeria,” said Robert Giles, Head of Retail Banking for Diamond Bank. “The service enables people to engage in secure, digital commerce, and access funds more easily in their bank accounts to make everyday purchases. mVisa increases the opportunity to include more Nigerians into the formal financial system, which will help the economy, and society grow.”

mVisa is available with software developer kits (SDKs) and access to Visa APIs, allowing banks and programmers to build additional solutions to help address local payment needs.

Related

-

Airtel partners Standard Chartered to boost financial inclusion in Africa

Mobile banking transfers between Airtel Money and Standard Chartered are now live in Kenya, Tanzania, Uganda and Zambia.

-

Nigeria behind in COVID-19 financial response, digital finance – IMF

Unlike other African central banks, the CBN has not lowered the usage costs of digital financial services to promote access ...

-

World Bank launches collateral registry in Sierra Leone to boost access to finance

Sierra Leone is the fifth country in sub-Saharan Africa to establish a modern, online collateral registry with the support ...

Sustainable Development Section Sponsor

Most Popular

- Rise in vaccine-preventable disease outbreaks is a threat, warn WHO, others

- Africa must stop buying what it already has

- AWIEF 2025 mobilising stakeholders to recommit to gender equity

- Finnfund issues EUR 200 mn multi-tranche green and sustainable bonds

- The rise of contemporary African art in a global market