What does Business Model Theory say about success in growth economies?

Feature Highlight

Understanding a company’s capabilities through its resources, processes, and priorities helps us understand why established companies today did or didn’t succeed, so aspiring entrepreneurs can now assess their own capabilities.

In my most recent research, I’ve been diving into the history of successful companies to understand their journey to success; specifically, the markets they helped create. By studying their histories and understanding company-specific strategies, my colleague Efosa Ojomo and I aim to widen the aperture and create a theory-based model to replicate the prosperity these organisations engendered.

If this sounds like a massive undertaking, it certainly is. But a simple, yet critical, tenet is guiding this process. Good theories are about understanding what causes certain outcomes under certain circumstances. Success in one circumstance won’t necessarily translate into success in another. This research isn’t meant to produce a step-by-step, foolproof guide. Instead, it will produce a reliable research-based model that aspiring entrepreneurs can leverage.

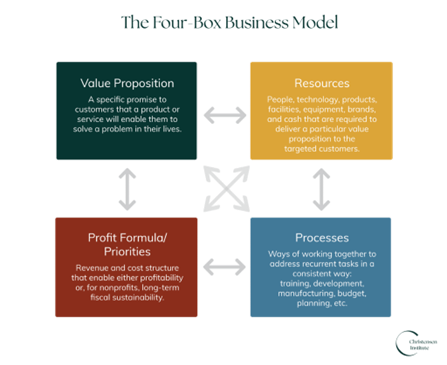

At the Christensen Institute, our research is also unique in that we have access to a toolkit of theories to help us understand how success and prosperity came to be in varying circumstances. For this specific research, I’ll start by harnessing one theory in particular: Business Model Theory, which reveals an organisation’s capabilities defined by their Resources, Processes, and Priorities (RPPs). This theory can help us all understand how companies are set up to succeed.

Your capabilities…

To know whether you are set up for success, you have to assess whether your RPPs align with the endeavour you are pursuing. Your RPPs will define what you can and can’t accomplish. Here’s a quick breakdown.

An organisation’s resources are usually tangible things, such as people, equipment, technology, product designs, brands, information, cash, and relationships with suppliers, distributors, and customers. Resources are flexible, meaning they can be transported across organisational boundaries; an engineer, for example, isn’t tied down to one company or one department for all eternity. As I look into the history of successful companies, I’m looking at what resources they started with. What was the source of their initial funding? What equipment and technology did they have access to? Did they leverage any partnerships to get ahead of competitors?

An organisation’s processes are patterns of interaction, coordination, communication, and decision-making as they transform resources into outputs of greater value. Processes can be formal, informal, and as they evolve into culture, can even be followed subconsciously. As I look into the growth of several companies from their foundation to where they are today, I want to look at their management. Not necessarily the management teams themselves, but how those teams went about making decisions, how they produced their product or service, and how they interacted with each other and with their value networks.

An organisation’s priorities are the choices that will be put ahead of others, and prioritisation decisions (of everyone in the company) need to be consistent with the profit model of the company. While resources and processes are often considered enablers of what a company can do, priorities can be considered constraints. So, over the course of a company’s growth, I want to consider what was given importance. What was developed in house, vs what was outsourced? What markets were targeted, what major technologies were adopted, and which were not? As the companies grew, how and when did their priorities change?

And your limitations…

As companies grow their capabilities as defined by their RPPs, these calcified capabilities can also become their limitations. Usually, at the start of a company’s life, their success can be attributed to their resources. But as they grow, their success starts to depend more on their entrenched processes and priorities. After all, their processes and priorities are there because they worked well to deliver the company’s value proposition, or the promise(s) an organisation makes to fulfil customer needs or goals. Yet, this dependence also becomes a limitation because if a proposed innovation creates friction with established capabilities, it won’t gain internal traction. Similarly, if it threatens the existing profit formula, it won’t survive.

As I study different companies and different sectors, and as I attempt to translate their success to new companies in growth economies, what I’m trying to identify are successful patterns. Processes that worked in some circumstances won’t necessarily work in others, even within companies. And it is important to note that if a company has not repeatedly formulated plans for competing in markets that do not yet exist, it is safe to assume that no processes for making such plans actually exist. Yet. (Which relates back to my point of this research producing a model and not a step-by-step guide.)

This means that aspiring entrepreneurs working to build market-creating innovations will need to create a new resource, process, business model, or some combination of these. This also means that as these entrepreneurs’ companies reach a certain level of success and look to continue to grow, they must not change the processes and priorities that enabled their core business to sustain its success, even as they develop new ones. Established companies may need to set up autonomous teams/businesses that have separate resources, new processes, and are unconstrained by existing priorities to go after new opportunities, so that the company doesn’t stagnate after initial success.

We can take Charles Schwab as a quick example. The financial services company can attribute part of its continued success today to having successfully established a disruptive online brokerage venture after it had already achieved initial success. The company was founded in 1971 and was already successfully leading an investor revolution when, in the 90s, they used their existing resources to set up an autonomous unit within the company. This unit had a business model that could prioritise cheap online trades by creating new processes and cost structures to do so. The online brokerage venture ended up being so successful that the core business was actually folded into the new opportunity.

Understanding a company’s capabilities through its resources, processes, and priorities helps us understand why established companies today did or didn’t succeed, so aspiring entrepreneurs can now assess their own capabilities, ask themselves similar questions to the ones I’m asking in my research, and decide for themselves if their capabilities have set them up to sustainably succeed.

Sandy Sanchez is a research associate at the Clayton Christensen Institute for Disruptive Innovation, where she focuses on understanding and solving global development issues through the lens of Jobs to Be Done and innovation theories. Her current work addresses how individuals can use market-creating innovations to create sustainable prosperity in growth economies.

Other Features

-

DeepSeek and the future of finance

The DeepSeek disruption is a clear signal that the AI landscape in financial services is about to undergo a seismic ...

-

How to sell USDT for cash in Nigeria: A comprehensive guide

Selling USDT for cash in Nigeria doesn’t have to be complicated.

-

A review of the national tax bills

The four tax bills signify a pivotal shift in Nigeria’s tax framework, focusing on critical areas of revenue ...

-

How Tinubu Deviates from IMF/World Bank reform recommendations

President Tinubu should not only adopt IMF’s policies, but he should also heed the recommendations for ...

-

The place of HWUs in ramping up Nigerian oil production

Local and international companies can invest in hydraulic workover units to address many of the challenges related to ...

-

Analysing the Lagos State Electricity Law

The Lagos State Electricity Law introduces some changes that differ from the extant federal legislation that ...

-

-

The outlook of Islamic finance in 2025

Islamic finance market expected to reach $5 trillion in 2025 – Muhammad Zubair, CEO of AlHuda CIBE.

-

5 elections to watch in 2025

Not as many people will get the chance to vote in 2025 compared with the previous year.

Most Popular News

- Artificial intelligence can help to reduce youth unemployment in Africa – ...

- AI Startups account for 43 percent of new unicorns

- MTN Nigeria records N400 billion net loss in full year 2024 results

- Analyst provides mixed reaction to Nigerian equity market performance

- Human Rights Watch says EU Commission waters down corporate rules

- Stakeholders agree to improve resilience of submarine telecoms cables